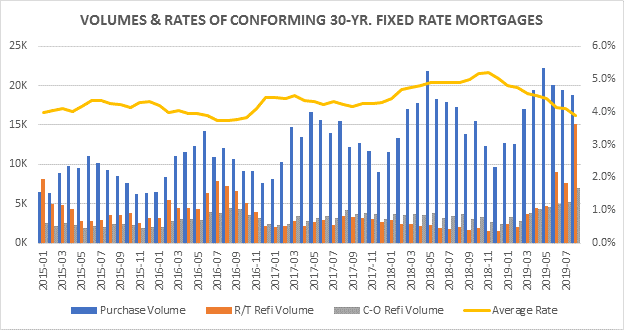

Mortgage originations are booming! While this is primarily fueled by the most recent refi boom, there are other aspects to this that, right now, are also favorable and adding fuel to the fire. The loan purpose is one of the main determinants of how volume will be affected by changes in the environment.

- Purchases – Purchase volume is most affected by seasonality, the cyclical trends in the mortgage market, much of which centers around the “school year” with summer having the largest volume months and winter having the lowest volume months.

- Rate & Term Refinances – When rates are low, or lower than they have been, more customers get “in the money” for a rate/term refinance. If rates are high or rising, the volume of rate/term refinances dries up significantly.

- Cash-out Refinances – This market is much less rate sensitive than the rate/term refinance market and much less seasonally sensitive than the purchase market. House price appreciation not only makes housing a strong investment, it helps to fuel the cash-out refinance market and plays an important role in allowing homeowners to access their equity.

Are we amid a perfect storm? Rates have been steadily declining for almost a year, house price appreciation has been strong (in most markets), and the summer is now over. These three factors are combining to create a very robust mortgage origination market.

The chart above clearly reflects the seasonality of the purchase market with regular peaks and valleys, the relative steadiness of the cash-out refi market over a period of consistent home appreciation, and the rise of the rate and term refi as rates dropped in recent months. Lenders are clearly enjoying the fruits of this “perfect storm” as originations expand.

So, what lies ahead? The seasonality of the purchase market would suggest that we should expect the market to slow down through Q4 and Q1. None of us know where interest rates are headed, but if they hold steady, we should expect rate and term refinances to temper as the pool of “in the money” candidates shrink with each refi. Finally, barring any big economic changes, home appreciation should continue to support a steady cash-out refi market. All in all, unless rates move considerably lower or higher, we will likely see some contraction in mortgage originations in the coming months.

ABOUT OPTIMAL BLUE mortgage market indices (OBMMI)

The Optimal Blue Mortgage Market Indices™ or OBMMI™ are uniquely positioned to provide unparalleled transparency into mortgage rates by utilizing observed, real-time lock data from approximately 30% of the market. This data is aggregated daily and split in informative and novel ways, covering not only conventional 30- and 15-year fixed rate indices, but also FHA, USDA, VA, and Jumbo, as well as many Detailed Mortgage Indices of the Conventional 30 group based on Loan-to-Value (LTV) and FICO credit score. The OBMMI deliver the most complete, frequent, and informative view of the mortgage rate environment based solely on observed, real-time transactions. For more information, please visit www.optimalblue.com/obmmi.