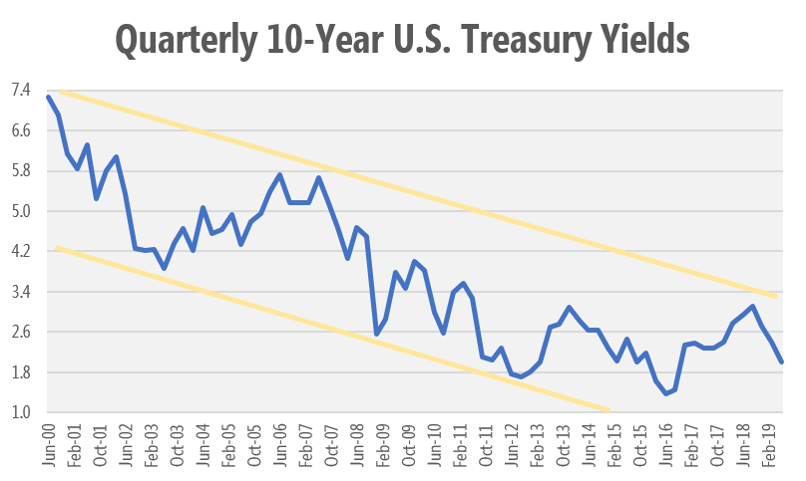

With the 10-year treasury yield at 2% again, and the Federal Funds Rate (FFR) at 2.5%, it is natural for the rational mind to assume that this cannot go on for much longer. During normal market conditions, the treasury curve slopes upward; typically, short-term treasuries yield less than the long-term treasuries yield. In our current environment, the FFR is higher than a two-year treasury. The Federal Reserve (Fed) will eventually need to bend to the market and cut their FFR in order to align their policy stance with the dual mandate and market conditions. In fact, the Fed pivoted for a second time this year during July’s FOMC meeting. They essentially removed the “patience” approach and are considering rate cuts if economic data weakens further. The market is expecting a 50bp cut to the FFR by September’s FOMC meeting… will they get it?

We do know that this rally to 2% will likely be short lived in the grand scheme of things. There will be some ups and downs, but the long-term trend is still bullish.

If a recession is defined as two straight quarters of negative GDP, it’s a matter of time before we see much lower GDP and hints of a recession. In the short term, typically interest rates fall before a recession because investors seek risk-free returns. A quick reversal (50bp FFR cut) could reverse the economic slowdown. The only soft landing we have seen in the past 30 years occurred when the Fed, with Greenspan at the helm, realized that they overtightened so they cut FFR several times shortly after their last increase. On the opposite side, if nothing is done, we will see slower GDP, lower rates, and a much worse ending to the current business cycle.

Sources:

http://www.hoisingtonmgt.com/pdf/HIM2019Q1NP.pdf

Board of Governors of the Federal Reserve System (US), Monetary Base; Total [BOGMBASE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGMBASE, June 25, 2019.

Federal Reserve Bank of St. Louis, NBER based Recession Indicators for the United States from the Period following the Peak through the Trough [USREC], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USREC, June 25, 2019.

Federal Reserve Bank of St. Louis, Excess Reserves of Depository Institutions [EXCSRESNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EXCSRESNS, June 25, 2019.

Bloomberg L.P. (2019) USSWAP10 BGN Curncy 6/30/2000-3/29/2019. Retrieved June 25, 2019 from Bloomberg database.