Published April 6, 2020

The COVID-19 crisis continues, and the mortgage industry is still reeling from its effects. Margin calls almost went too high for the industry to stomach, investor and agency cash pricing is awful, and March mark-to-market (MTM) results are ugly, though pull-through seems to be holding. Is there a light at the end of this tunnel? Let’s dive into some more detail below, but it seems that there may be… for now.

MARGIN DRAMA

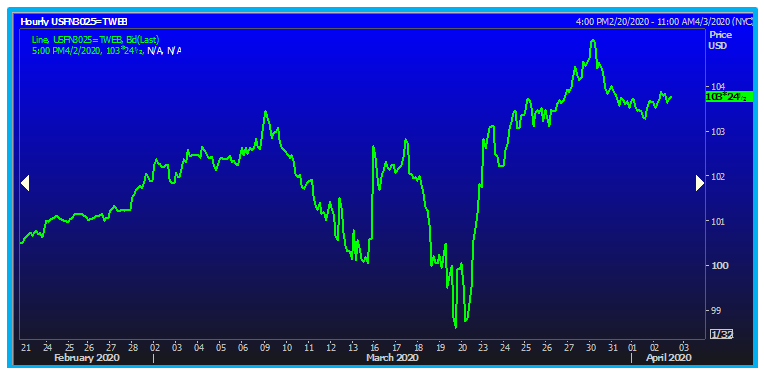

As the graph below demonstrates, here is the 2-week saga. As the spread of COVID-19 sparked major fears of an economic meltdown, the Fed began buying MBS on March 15, and then more aggressively on March 23, with no limit to speak of. MBS prices hit record levels in a blink, with the UMBS 2.5 rising more than five points in five days. This run-up put extreme capital strain on all participants in the supply chain, particularly mortgage bankers, investors, and bond dealers. Margin calls reached levels that would make Warren Buffet cringe, so by March 27, the industry was crying “uncle.”

Outcry from the MBA and other influencers contended that this valiant effort to lower borrowing costs, provide liquidity, and create market stability was threatening to cause a major disruption to the mortgage industry. Just as margin calls were threatening to jeopardize operating cash, the Fed received the message, and on March 30, the MBS market reached a peak and then sold off for two days – to the relative delight of all involved. Since then, the MBS market has traded in a very tight range, about one point below all-time highs. Margin call crisis averted, for now…

PRICE BASIS WIDENING

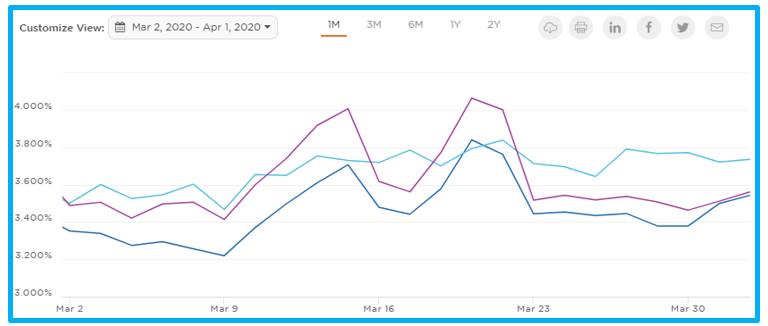

As discussed in our previous blog post tiled “COVID-19 and its Impact on Today's Mortgage Pipelines,” while the Fed has been pushing MBS prices to dizzying levels, borrower rates have remained stagnant. Please review the Optimal Blue Mortgage Market Indices (OBMMI) to further understand what rates were being locked during this historic rally.

The disconnect between MBS pricing and actual whole loan pricing has created major problems for all originators, especially those who are hedging and delivering mandatory. All originators are finding it difficult to offer decent rates and pricing to their borrowers, and larger lenders are also seeing MTM valuations dropping precipitously.

To put it simply, as MBS prices are surging, the price that investors are paying for loans are stagnant or are dropping. There are market dynamics such as virus-related unemployment that is threatening to destroy servicing values by increasing servicing costs and capital outlays, economic conditions causing business and/or investor borrowing costs to increase, as well as the interest-only market softening, which drives certain components of loan valuation. However, these factors likely account for only a small percentage of the dislocation between MBS and loan pricing.

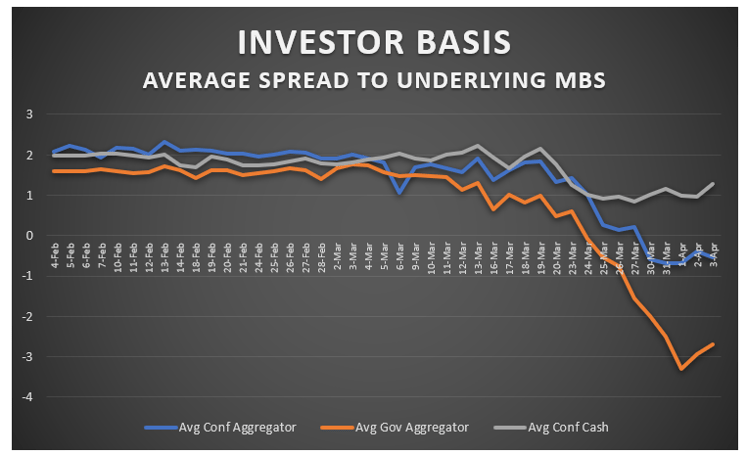

The graph below illustrates the spread between average whole loan and cash window pricing versus the underlying MBS prices. Normally, this spread is fairly consistent. Some deterioration in this spread is expected in a rally, as you can see through February. This is driven by changes in servicing value (MSR or SRP) and most hedge models are designed to account for this.

However, in March, the spread changes became erratic and extreme. To further demonstrate, let’s look at conventional pricing and let’s assume that an average conventional loan MSR is 1.00 points. That value was wiped to zero between March 23 and March 25. Since then, prices have worsened by an additional 1.00-1.75 points, for a total of 2 to 2.75 points total disconnect between the prices of MBS and that of conventional whole loan pricing. The situation is worse for government loans, where the deterioration is around 4 points. Even cash window pricing has deteriorated 100 basis points.

This spread problem is the reason borrower prices have not improved while the MBS market has improved by 3-4 points. This is especially problematic for lenders who hedge with MBS because the value of hedges has predictably worsened with no counterbalancing improvement in loan prices, causing intense short-term (hopefully) pain in pipeline values (MTM) and poor loan sale execution.

As of this writing, spreads seem to have bottomed, which could be great news. However, we saw false bottoms earlier in the month. We will keep a very close eye on these spreads, as usual. In the meantime, selling servicing retained is recommended, if you have the option, and selling regularly – as opposed to holding out for a market rebound – is probably wise.

POOR MARCH MTM

The story is simple as it relates to this topic. March MTMs were beat down badly by the severe deterioration in investor and agency cash pricing. These values have suffered anywhere from 50 bps to 200 bps drops between February and April. There is not much that can be done to legitimately salvage March’s MTM values, but hopefully we see continued improvement in pricing and thus a return to “normalcy” soon.

PULL-THROUGH DETERIORATION

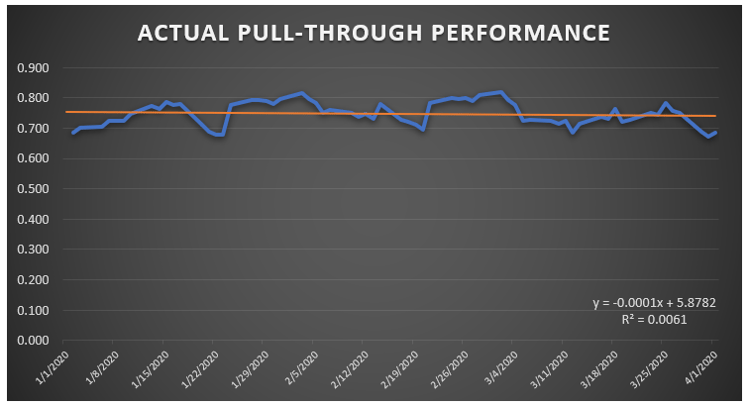

Also discussed in previous blog posts and throughout the industry is the thought that virus-related business closures, layoffs, quarantines, and other effects will drive more loans to fall out of mortgage pipelines.

The graph below reflects actual pull-through performance in real time, across all Optimal Blue hedge clients. Data has not yet shown a major decline in pipeline pull-through performance, but lenders should continue to actively manage pipelines and should discuss preemptive pull-through assumption changes with their hedge providers.

WHAT'S NEXT?

March was the craziest month this industry has seen since the 2007 financial crisis. We are all tired, nerves are frayed, and we are reluctantly accepting the reality that we don’t know how long COVID-19 will keep us in our homes, nor do we know when the secondary market will settle into a consistent pattern.

Last week, there were some encouraging signs coming from the secondary market. Price basis seems to be rebounding a bit and the Fed seems to be getting the hang of stabilizing MBS prices. This week will be another adventure.

As always, keep an eye on those spreads and actively manage your pipeline! To aide Optimal Blue clients as they navigate this new normal, our team will host an interactive client webinar this Thursday, April 9, 2020 at 1:00 PM CDT.

If you are an Optimal Blue client that would like to attend the webinar, or if you have additional questions related to this article, please do not hesitate to contact Optimal Blue.