Assignments of Trade (AOTs) have existed in the secondary mortgage market for decades, though a variation that may be somewhat unfamiliar is the bid tape AOT. While it has existed for a couple of years, the industry is just now starting to see exactly how pervasive it has become over the past year. The bid tape AOT execution provides many of the same advantages as the standard AOT execution, but also maintains the benefit of live bid pricing. Let's examine this process more closely!

Historically, most mortgage lenders who deliver via mandatory execution utilize MBS/TBA securities to hedge their open pipeline. These securities are traded with broker-dealers with whom the lender has an existing relationship. When it comes time to commit closed loans to investors, the lender essentially has two options for closing out an MBS/TBA position. They can either "pair-out" the position with the broker-dealers to ensure that the transaction will be settled – understanding that there may be a transaction cost – or, they may assign the trade to an investor that is purchasing loans from the lender.

When incorporating bid tape AOT as an option, the lender can deliver the loan and simultaneously assign the MBS/TBA trade to the investor. The bid tape AOT strategy then allows the lender to:

- Receive the full price enhancement benefits of delivering via live bid

- Smooth out cash flows, reduce trade MTM and probability of margin calls

- Potentially reduce trading costs

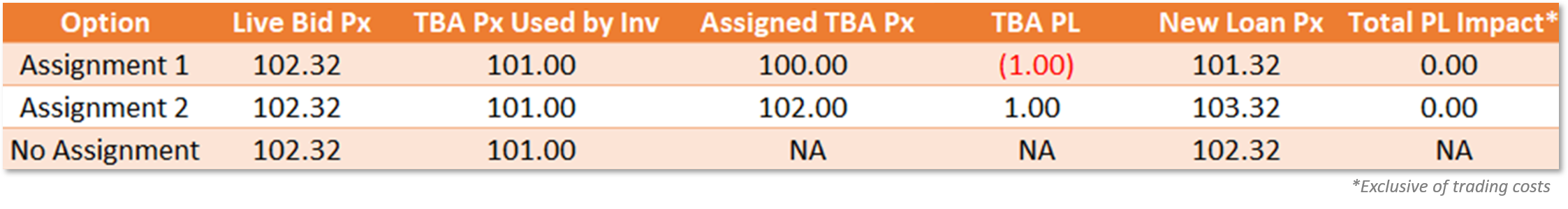

The math used to calculate bid tape AOT pricing is fairly simple. The value of the trade assigned to the investor is applied to the price of loans delivered, subject to any investor rules or restrictions regarding coupon matching and tolerance.

The table below illustrates a few different scenarios.

Should I utilize bid tape AOT?

- If you are concerned about margin calls – YES! Assigning trades will reallocate MTM gains and/or losses from your position to that of your investor.

- If you are generally concerned about cash flow imbalances – YES! By assigning trades, you essentially combine trade and loan settlement into one transaction and will settle only with the investor, not with your dealer.

- If you are delivering more than 1-2 loans to an investor that offers bid tape AOT – then YES! Even if the first two points don't pertain to your organization, there may still be extra gains available when executing via bid tape AOT.

- If dealing mostly with the primary dealers and employing an efficient hedge strategy, you can expect 0-2 bps on assigned loan volume. That is, if you are receiving screen or better pricing and are rolling trades as you adjust coverage after committing loans, you already avoid any dealer price markups and most or all of the bid/offer (B/O) spread. So, gains here will be minimal.

- If dealing primarily with regional brokers and employing an efficient hedge strategy, you can expect 2-5 bps on assigned loan volume. By assigning trades, you avoid the spread that the dealer has added or subtracted from the screen price, as well as on any coverage lifted when committing loans. Keep in mind that those employing a roll strategy are already minimizing these costs, so even if your broker is taking a full tic from the screen, you will be in this 2-5 bps range.

- Best case – or worse, depending on how you look at it – is if you are dealing with regional brokers who take a full tic off of the screen and are employing an inefficient hedge strategy (outright lifting when committing loans). In this scenario, you can expect to regain the tic that the dealer is extracting plus the full B/O, which is typically 1 tic but can be more.

- Assigning trades with negative MTM value may be right for you, as it allows you to essentially transfer this liability to the investor while not impacting your overall P/L. Most investors will not pay a pair-off to the loan seller and if a loan is denied by the investor, you don't miss out on the intrinsic value of that trade by pairing-off.

- The over-assigning strategy (I.E., assigning a higher dollar amount of trades relative to the dollar amount of loans delivered) can help you save on B/O if you have illiquid instruments in your position and at least some loans that match them. Assign them! When you approach a margin call threshold and wish to avoid a call, assign more than you need to match the loan population. Most investor policies allow you to assign well over the amount of loans delivered.

Click to watch the Bid Tape AOT webinar recording

There is much to learn and even more to consider when deciding when and how to deliver bid tape AOT. If you are looking to smooth out cash flows, reduce MTM exposure, avoid margin calls, and/or reduce trading costs, you should evaluate bid tape AOT as a potential weapon in your execution arsenal. This variation does carry nuances and considerations so if this is a strategy that you are considering, I encourage you to watch the INTRODUCTION TO BID TAPE AOT webinar that I recently hosted on the subject.

I hope this commentary helps as you navigate some of the questions surrounding this relatively new delivery method. Please do not hesitate to reach out to the Optimal team with any questions you may have – we’re here to help!