The COVID-19 (Coronavirus Disease 2019) pandemic throughout the world continues to become more critical by the day and most experts predict things will get worse before they get better. The impact on society, the world economy, and our industry remain to be seen, but the short-term effects on mortgage pipelines may be something that can be managed. Now more than ever, it is important to communicate, understand current risks and opportunities, and to react quickly to this ever-changing crisis.

Current confirmed cases have surpassed 400,000 with over 18,000 deaths worldwide, but it is assumed that many more are infected, but just haven’t been tested. Across the U.S. and across the world, citizens are being told to stay home or are doing so voluntarily. Markets across the world are reeling, with some volatility measures showing higher ranges than we saw in 2008. Central banks are making major moves to stabilize markets, with some success, but equity markets are still down ~35% from February highs.

Lenders are now trying to estimate what effect Coronavirus-related issues will have on their ability to close and sell loans, and the resulting profit of loan origination activities during the outbreak. Let’s recap the last month of madness and then get into those details.

To Recap Last Month...

- February 19, 2020: A major bond rally kicks off, as equity markets tumbled on worsening projections about COVID-19 and its potential effects on the world economy. The rally seemed to be somewhat “normal” by historical standards. Rates dropped, pipelines grew by around 50%, and we all worried about the typical things we worry about in a rally… wider margins, MTM exposure, cash flow, rate renegotiations, capacity, and general pipeline dynamics.

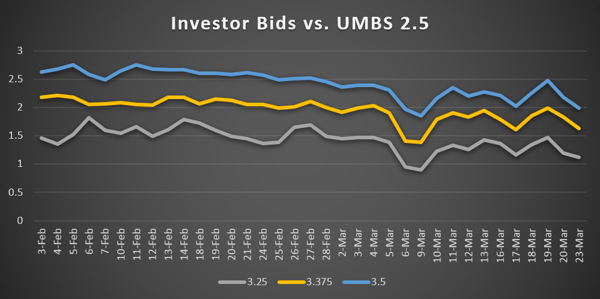

- March 4, 2020: Volatility spikes, and equities make another hard move DOWN. Rates start to go UP, which is unsettling, given the “normal” relationship between stock price movement and bond rates. Normally, when funds move out of equity markets, they mostly move into bonds. In this case, it seemed as if money was flowing out of pretty much all investments. Meanwhile, investor pricing, which normally worsens predictably relative to TBAs during market rallies, starts to really become disjointed from MBS market movement, as investors become worried about a multitude of issues. Lenders continue to raise margins.

- March 15, 2020: The Federal Reserve announces that it has lowered short-term rates to zero, and it will purchase $700MM in treasury and mortgage bonds. This was a move intended to prop up debt markets and generally keep money flowing through the financial system. Investor bids become even more volatile versus underlying MBS prices. Lenders continue to increase profit margins, and locked rates actually rise over the week.

- March 23, 2020: The Fed pledges to execute virtually limitless asset purchases to support market function during the COVID-19 outbreak. The program still includes treasuries and MBS, but now extends beyond these “safer” assets into credit cards, student loans, and more. MBS prices surge higher, finally driving mortgage rates lower.

New-ish Uncertainties in Mortgage Origination

Loan Valuations in Question

There is increasing fear that layoffs and unemployment will trigger a wave of previously unexpected loan defaults, resulting in losses to investors and servicers. This concern has worsened investor pricing further, which was already a concern. Most non-QM and non-conforming investors have ceased accepting new or even existing applications, as the private securitization market may be seizing. Also, this week many co-issue buyers have completely pulled out of the market signaling that MSRs are extremely difficult to value. Lenders have coped with much of this by increasing margins further and ensuring that they are offering loans to multiple investors in order to fetch the best possible price for every loan they produce. This week’s newfound market stability may offer some firming of investor bids, but loan default and servicing cost uncertainty are likely to impact investor pricing for the foreseeable future. The decision of whether to sell loans in this market or “hold” – if that’s an option – is still a tough one. Lenders should consider all risks and opportunities and discuss with their hedge advisor when making these decisions.

Fallout Assumptions in Question

Also, worries are mounting that loans will become difficult to close, and/or borrowers will walk away from loan locks due to Coronavirus-related closures, lockdowns, layoffs, and general fears. You’ve likely heard about COVID-19 disrupting supply chains for everything from cell phones to automobiles. There is a specific supply chain that must function properly to produce a loan as well. The effects of the virus on loan origination pipelines will be difficult to predict, and related assumptions will likely depend on the area of the country and will change by the day. Specific concerns include:

- Appraisals: Initially, the main concern was that appraisers would not be allowed or would not want access to homes. Fannie and Freddie just recently announced that they are making temporary exceptions to appraisal requirements, which should help ease some concerns here.

- Municipalities closing: There remain challenges here that Fannie and Freddie are working to address.

- Businesses closing: Obtaining a VOE may become more difficult, but Fannie and Freddie have offered some relief here too.

- Title companies closing: Might this crisis push the adoption of e-closings in the industry?

- Borrowers backing out at closing due to market fears: With an economic slowdown imminent, home price deterioration is likely. Borrowers may walk away from purchase contracts.

- Borrowers simply not wanting to close due to fear of virus exposure: Borrowers may decide that they don’t want to be around people, so e-closing may be the only option.

- Borrowers losing their jobs prior to closing: Layoffs, furloughs, and business closures are already happening. VOEs will come back negative.

Many of the items above could cause a delay in closing, at the very least, but items such as job losses could cause loans to fall out entirely. So, it is almost certain that fallout percentages will increase during the progression of the COVID-19 outbreak. Active pipeline management is more important than ever, and lenders know their operations better than anyone. Without a model or history to help predict what happens to a loan pipeline during a pandemic, lenders should work with their hedge advisors to come up with estimates. There are some ideas floating around the industry about creating hypotheses around how fallout will be affected. For instance, loans with monthly incomes consistent with retail or service industry jobs, and loans in areas of the U.S. highly affected by COVID-19 may be considered as unlikely candidates to close.

In any case, estimates can be implemented immediately, and then pipelines can be monitored frequently to examine actual results as the industry figures out how to function in this new environment.

Communication is Key

The fact remains that the pandemic presents a very fluid situation for many businesses. In our industry, active observation, dialogue, management, and quick reactions will help stabilize positions and profitability, as well as help ensure lenders are minimizing risks and maximizing probability of success while navigating through this unprecedented event.

Helpful Links

- Fannie Mae Lender Letter: Impact of COVID-19 on Originations

- Freddie Mac Bulletin: Selling Guidance Related to COVID-19

As a proactive Hedge Analytics provider, the Optimal Blue team is already discussing all of this information with clients and will host an interactive client webinar this Thursday, March 26, 2020 at 1:00 PM ET.

If you are an Optimal Blue client that would like to attend the webinar, or if have additional questions related to this article, please do not hesitate to contact Optimal Blue.