Published March 15, 2022

Interest rates rose sharply in recent months against the backdrop of inflation concerns and what is expected to be an accelerated pace of Fed policy tightening.

The 30-year-fixed mortgage rate rose almost 70 basis points in the first two months of 2022, according to Black Knight’s Optimal Blue Mortgage Market Indices (OBMMI), as the Fed cut back on bond purchases and allowed the yield on the benchmark 10-year treasury bill to rise.

As reported in our most recent Mortgage Monitor, rising rates in the early weeks of 2022 cut the population of high-quality refinance candidates by 65% – from 11 million to less than 4 million – accelerating the shift to an equity-centric refi market.

The 3% meridian – as defined by the interest rate on a conforming 30-year fixed rate loan – has been a line of demarcation during the recent pandemic rate cycle. When rates have dropped below the line – as they did in the second half of 2020 and briefly this past summer – rate/term refis increased; above the line, demand has shifted in favor of cash-out refis and purchase loans. With the 30-year fixed mortgage rate now above 4.25%, the market has made an equity-centric shift.

Not everyone who wants to take advantage of lower rates is ready or able to do so when rates are optimal. When rates adjust gradually, more borrowers can lock-in at a rate close to what they wanted. When rates are rising rapidly, however, borrowers become motivated to pay more upfront in discount points to lock in a lower rate for the long term.

Our Optimal Blue rate lock data shows demand for rate buy-downs has soared in 2022, as borrowers reached for a little extra, knowing even a 25-basis point difference could add up to tens of thousands of dollars in savings over the life of the loan.

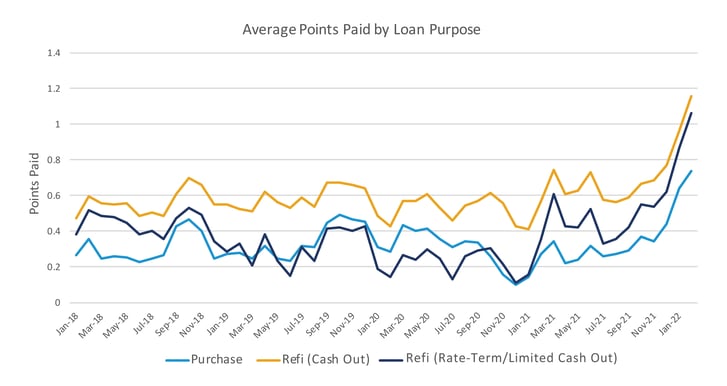

Exhibit 1 shows the recent spike in buy-down activity as interest rates have increased. Average points paid are up among homebuyers as well as those looking to refinance their current mortgage. Average points paid are up 30BPS among purchase locks and roughly 40BPS for both rate/term and cash-out refis over the past two months, and up over 45BPS (as much as 70BPS among rate/term refis) from the same time last year.

Exhibit 1

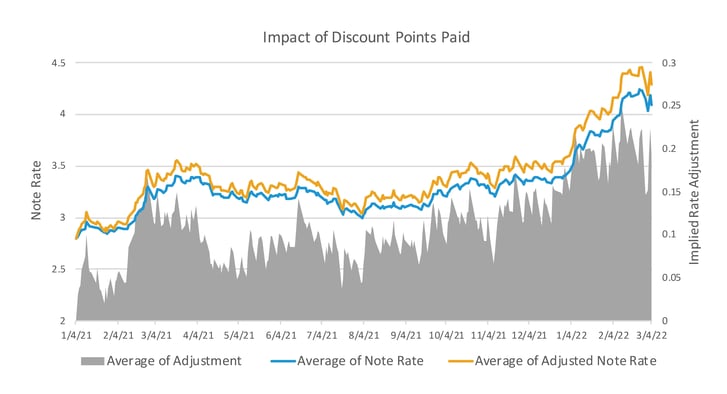

Without borrowers coming out of pocket to buy down their rates, 30-year rates would be up even more than they already are. Exhibit 2 illustrates the effect of recent buy-downs on interest rates. The shaded area represents the estimated effect of buy-downs on the 30-year fixed conforming interest rate using a widely accepted multiplier of 25 basis points for every point paid. The lower line represents actual interest rates while the upper line is our loan-level estimate of where rates would have been without buy-downs.

Exhibit 2

Although buy-downs can help borrowers lock in a lower interest rate for the long term, points represent an additional cost – alongside increasing down payments and larger monthly mortgage payments due to rising home prices and interest rates – that need to be factored into the housing affordability equation. On the other hand, points can be rolled into the loan amount in a cash-out refi, so it is likely that this trend will continue as the market becomes more equity-centric.

We will be watching this closely as housing prices continue to rise in the weeks and months ahead.