Published August 19, 2021

The right hedging instrument is integral to effectively managing pipeline risk and increasing returns. Whether your institution is new to mandatory delivery, or you are interested in re-evaluating your current hedging approach, the most important consideration should be risk management for your pipeline – how can you most effectively mitigate the increased risk of mandatory delivery and fully realize the associated benefits?

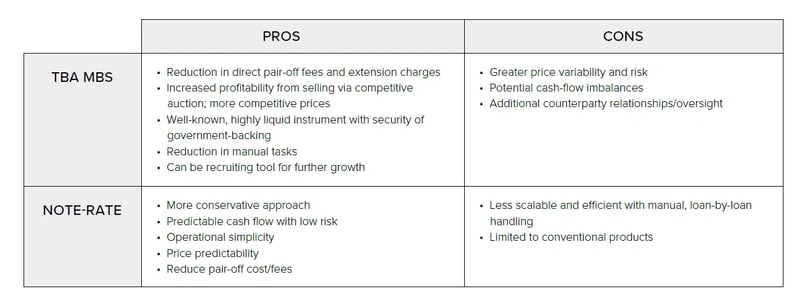

To-be-announced (TBA) mortgage-backed securities (MBS) hedging and note-rate hedging represent two common pipeline risk management strategies, each offering unique benefits. But which instrument is the right option for your business?

TBA MBS hedging involves the use of a well-known, highly liquid hedging instrument, but it can come with greater price variability and risk. Note-rate hedging, on the other hand, offers a more conservative approach, but the method can compromise scalability and efficiency without suitable technology.

The following chart provides an overview of the advantages and disadvantages of each instrument.

Black Knight’s latest white paper takes a deep, objective dive into each hedging strategy to help you determine the right option for your organization’s goals and risk appetite.