Drive Profitability & Success With Comprehensive, Industry-Leading Hedge Analytics & Software

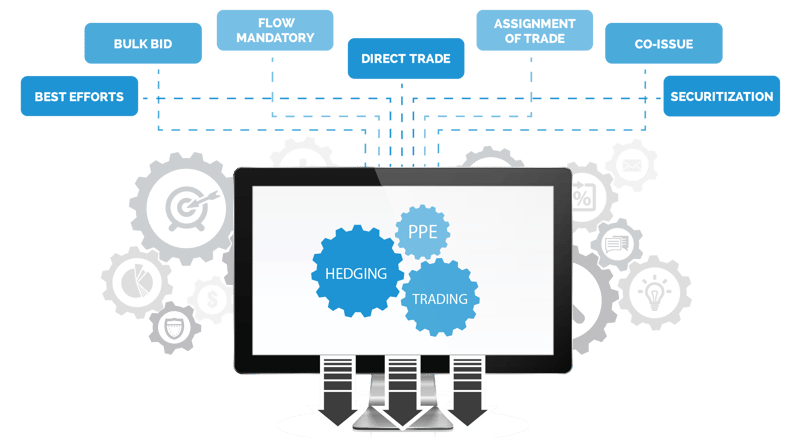

Our comprehensive hedge analytics solution delivers a unique combination of robust hedging functionality, industry best practices, and trading desk services to help leading mortgage lenders confidently manage your pipeline risk.

- Jim Glennon, Vice President, Hedging and Trading Client Services, Optimal Blue

Integrated with our leading PPE, pipeline valuations are always precise and error free

Full-service, hybrid, or self-service models drive success for any strategy or budget

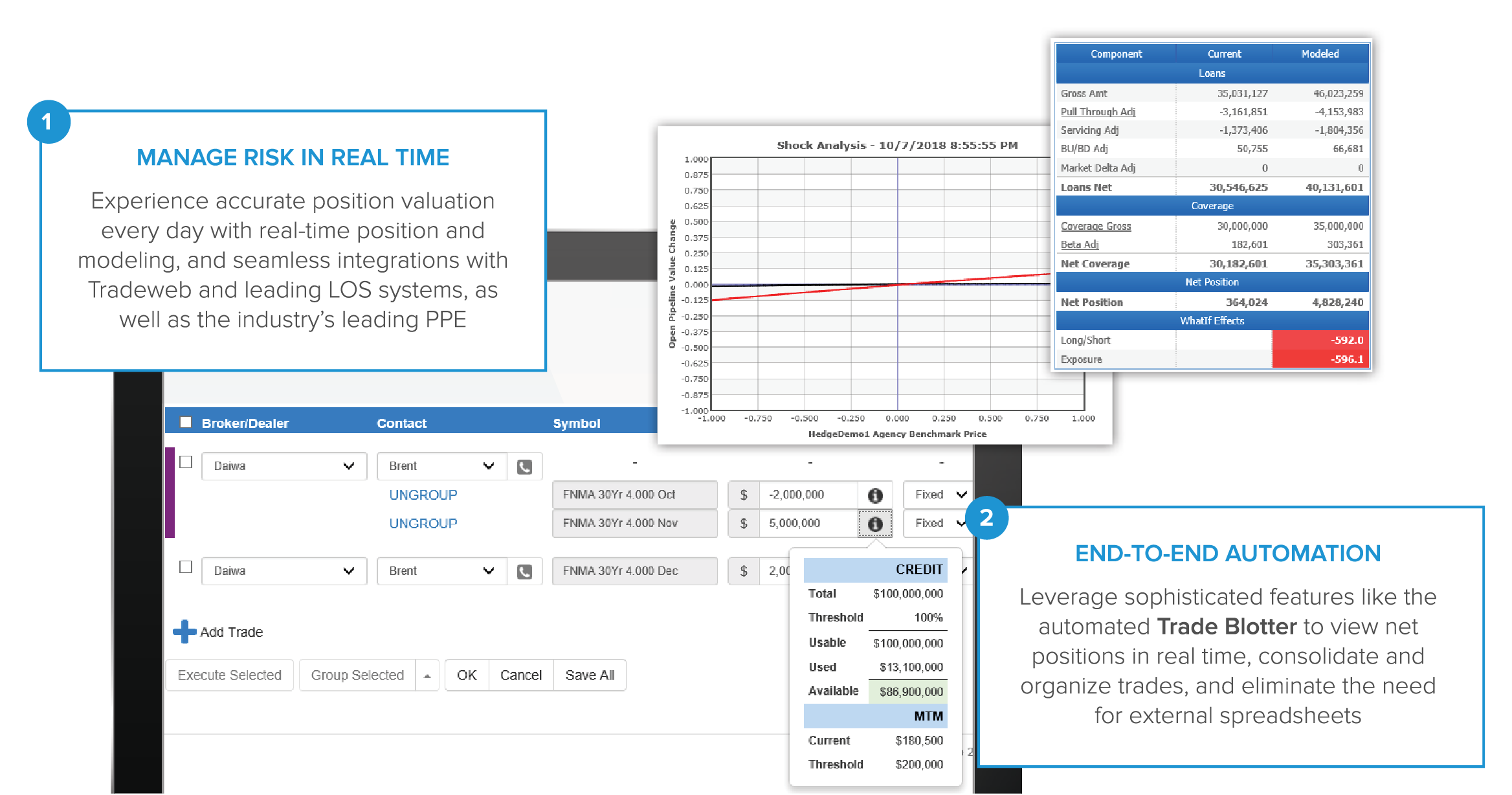

Shock analysis and pull-through granularity predict position and P/L to optimize coverage

Personalized to your business, measure and manage risk at the note-rate level or with TBAs

Powerful, robust data scrubbing instantly identifies logic and eligibility errors

Model coverage and execute multiple trades with automation, not spreadsheets

Model Risk Position and Production

Live modeling functionality and exclusive shock analysis tools enable mortgage lenders to easily compare their current hedge positions to modeled positions.

THE BEST EXECUTION EVERY TIME

Optimal Blue’s hedge analytics platform will recommend the best alternative across all possible executions, providing you with the industry’s only True Best Execution.

This information is subject to change at any time and without notice.