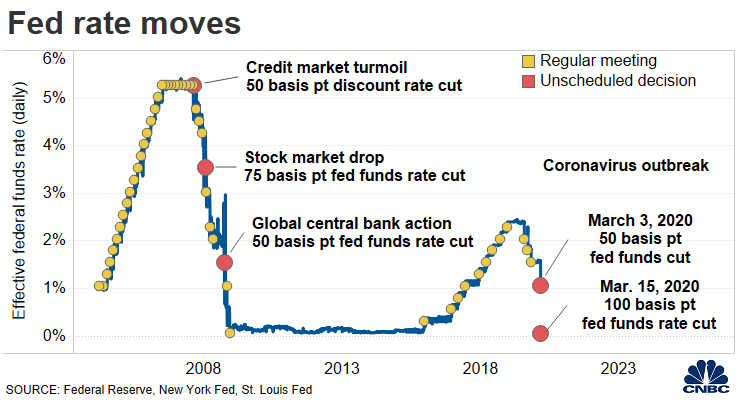

In response to the COVID-19 (Coronavirus Disease 2019) pandemic, global economic conditions, and the economic uncertainty that social isolation protocols have induced, the Federal Reserve Open Market Committee (FOMC) just made its second emergency rate cut over the past two weeks, and just a few days ahead of its previously scheduled March 17-18, 2020 meeting. While the first emergency action on March 3, 2020 decreased the Fed Funds rate1 by 50 basis points, the March 15, 2020 action cut the Fed Funds Rate by 100 basis points to between 0% and 0.25%, and announced Quantitative Easing2 (QE) of $700 billion dollars, with $500 billion earmarked to purchase treasury securities and $200 billion to purchase Mortgage Backed Securities (MBS). These emergency actions are designed to stabilize the markets and economy in the long run, although they do induce some uncertainty and volatility in the short-run, because the realized outcome is not in line with expectations. These steps are intended to ensure the continued functioning of the markets and to keep liquidity in the mortgage market specifically.

[i](Cox, 2020)

Primary mortgage rates are generally closely associated with the yield on the 10-year treasury note, not the Fed Funds Rate. However, both the uncertainty induced “flight to safety3” and the QE programs should have the effect of decreasing the yield on the 10-year treasury note. As the economy stabilizes to a new (short-term) normal with social distancing being widely practiced and much of the commerce moved to online platforms, it remains to be seen if and when mortgage rates will stabilize. For more information on the relationship between mortgage rates, treasuries, and volatility, read the recent blog Market Volatility and the Anatomy of Mortgage Rates.

While all eyes are on how to react to the short term effects of the recent FOMC decision and the ensuing volatility, we can begin to look ahead to what to expect in the coming months as well. Decreased home sales will likely be a reality, as there will be less of both supply and demand because of the COVID-19 concerns. This will put pressure on originators’ pipelines as we begin to enter the prime season for purchase activity. The FOMC’s actions this week (and in the future) will likely put downward pressure on interest rates. This is potentially a silver lining for originators as it should impact the following areas:

- Help with liquidity in the mortgage market.

- Provide some stabilization of loan pricing as the market recovers.

- Refinance activity could continue to flourish as interest rates start falling again.

- There may be an increase in HELOC or Cash-Out refinances to give households the needed short-term liquidity.

However, if the pandemic starts to adversely impact large segments of the economy, we could see a full and deep recession, which could see default rates rising and home prices falling. In this case, additional policy actions, such as the recent decision by various agencies to suspend foreclosuresii, may be necessary.

The FOMC’s actions have been quick and decisive to this point, and it appears that both the FOMC and the federal government are actively trying to minimize the economic impact of COVID-19 on the overall economy, industries, companies, and individuals. The intent is that much of the domestic impact will be muted by FOMC and government intervention. There are also future considerations around the effectiveness of monetary policy with interest rates near zero, the size of the Federal Reserve’s balance sheet, and how to potentially raise rates far enough away from zero without putting the economy through a major recession.

[i Cox, J., 2020. Fed Cuts Rates by Half a Percentage Point to Combat Coronavirus Slowdown. [online] CNBC. Available at: <https://www.cnbc.com/2020/03/03/fed-cuts-rates-by-half-a-percentage-point-to-combat-coronavirus-slowdown.html> [Accessed 16 March 2020].

[i][i] Lane, B., 2020. Fannie Mae, Freddie Mac, HUD suspending all foreclosures and evictions. [online] Housing Wire. Available at: <https://www.housingwire.com/articles/fannie-mae-freddie-mac-hud-suspending-all-foreclosures-and-evictions/> [Accessed 18 March 2020].

[1] Fed Funds Rate is the rate that banks charge each other on overnight cash loans.

[2] Quantitative Easing is when the Federal Reserve buys assets expanding its balance sheet to inject liquidity into the markets.

[3] “Flight to safety” is the movement from the riskier (often stocks) to less risky (bonds, particularly treasury bonds).