Some years ago, I authored an article in which I was advocating “the new” bid tape process and encouraged readers to give it a try. It seems a bit trite at this point, as so much has changed over the last few years. I feel obligated to revisit the status of this strategy and what we can expect as we look forward. Let’s start by reviewing the factors that led to this transformation.

It is difficult to notice the slow progress of change as life carries on. If we consciously step back and take a moment to look, the magnitude of change becomes quite clear. Think about the adoption of smartphones. Within five years, they were ubiquitous. Does anyone ever think to look something up in the yellow pages? I mean the old-school, printed, yellow pages.

That was a rhetorical question – of course not!

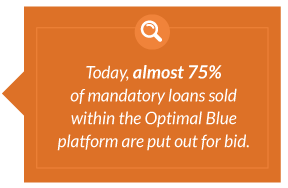

Today, almost 75% of mandatory loans sold within the Optimal Blue platform are put out for bid. Approximately 60% of those loans are sold into a price generated through that bid tape process. To put this shift into perspective, less than 5% of loans were sold through a bid tape process just few short years ago. Obviously, the way we sell loans today is vastly different from the processes of yesteryear, and I would claim that this is only the beginning.

Probably the most significant factor in the adoption of the bid tape process has been the number of investors in the market. There is a healthy nest of active investors and with increased investor competition, comes a healthy market. Lots of originations, lots of buyers, and a whole lot of optimism in the securitization sector. All good… right?

Additionally, we are starting to see investors introduce more traditional aspects to the bid tape process, such as direct trade and assignment of trade strategies. While the technology may not have fully caught up to these creative strategies, it will soon.

So, where do we go from here?

My suggestion from a secondary market perspective, is to make sure that you are constantly improving your processes! Leverage pricing visibility to sell loans efficiently. Employ accurate and timely investor data and be certain that your pricing system is configured appropriately. I encourage Optimal Blue clients to review price sourcing and explore margin strategies with your Client Services Representative. They will make sure you are taking full advantage of the latest innovation, features, and functionality available within the Optimal Blue platform.

On the loan sale side, it’s also important to use the latest tools so that you can maximize your best execution strategy. Again, the foundation is accurate and timely product eligibility and pricing. With that key component, you should be able to look across all potential executions with all investors – not just the ones you have a relationship with. You may decide to not always sell simply based on price, however. If other factors supersede best price, you will be equipped with the tools to quantify the cost of such a decision, what we refer to as ‘advanced decisioning.’

Finally, you need to organize your bid tape process with a systemized approach, one that you would find in a robust platform like Optimal Blue’s Resitrader. The data is already populated in the system allowing investor participants to respond based on the timeframe you set. This approach allows you to automatically open the pool to potential investors so you can easily compare and digest the variances. I implore you to consider moving to a digital loan trading process to best enable your organization to compete in this ever-tightening market.

As with any competition, there is no short cut! Organizations that can be agile using clear communication, a culture of continuous process improvement, and advanced decisioning will notice a significant competitive advantage. Begin today by evaluating your systems and processes to determine where improvements can be made. Reach out to your vendors and seek their help, that’s the reason we exist!