Many metrics contribute to a successful mortgage pipeline hedging strategy. While measurements such as pull-through rate are generally understood, others—such as duration—offer an opportunity for deeper knowledge across the mortgage industry.

In the finance world, duration has varying definitions, but in the context of hedging it represents the speed at which the values of loans change with respect to fluctuations in the underlying interest rates.

Here are top reasons why lenders should consider and understand all components of duration as part of a thorough and effective hedging approach.

- Understanding the duration of all assets enables proper matching of loans and hedge.

When lenders hedge loans with assets that move with the same underliers—such as a to-be-announced (TBA) mortgage-backed security (MBS)—it’s important to understand the duration of all assets in their portfolios. This enables matching loan duration profiles and applying their hedge accordingly. Setting a benchmark duration can also help lenders simplify hedging decisions with the use of hedge/duration ratios. Hedge or duration ratios can allow hedgers to quickly make hedging decisions by normalizing the position to the benchmark.

- Loans and hedges can contain different components, and hence, different duration profiles.

Loans and hedges don’t necessarily have the same duration profiles since they contain different components. For example, a loan may have a servicing asset embedded into its value at origination; this asset is not present in the eventual MBS toward which the TBA hedge is intended. In interest rate shocks, the servicing right also moves inversely to loan valuations, making it a partial hedge to the loan asset.

What’s more, duration profiles vary across different types of loans. A high-balance loan has a different duration than a standard-balance loan. It’s also worth mentioning that a lender’s pipeline isn’t composed entirely of 30-year loans—typically there are also 10-year and/or 20-year loans. These loan duration profiles don’t align perfectly with TBA hedges. Hedgers typically don’t sell forward 10- or 20-year TBAs due to low liquidity, and as a result they tend to be hedged with more liquid 15- or 30-year TBAs. The more “cross-hedges” a lender has, the more important it is to factor in duration profiles.

- Economic incentives for refinancing differ between different types of loans impacting duration.

A lender might pose the question of whether the duration profiles of high-balance loans matter when selling to aggregators, rather than securitizing the loans themselves. A high-balance spread affects pricing differently than a TBA MBS. Therefore, to hedge effectively, lenders must understand the differences in duration profiles between the high-balance pool and a UM30. By knowing the ratio between these two securities, they’re better equipped to hedge the high-balance spread using UM30 hedges.

A lender might also wonder whether the duration of the standard-balance loan is close enough to be a suitable hedge. This isn’t necessarily the case.

The economic incentives for refinancing are different between high-balance and standard-balance loans. Specifically, a high-balance loan brings greater propensity for prepayment because the borrower has greater potential for interest savings over the life of the loan. Similarly, higher prepayment risk typically means lower duration – e.g., a lender needs fewer UM30s to hedge a high-balance loan than a standard-balance loan.

Essentially, if lenders aren’t using duration profiles for certain securities – such as 20-year, high-balance or low-balance loan pools – they aren’t hedging their pipelines as effectively as they could be. They may be over-hedging high-balance loans and under-hedging low-balance loans.

Consider the following example in which $10 million of closed loans – some high- and some standard-balance – go into a 2.5% coupon. Even if the lender hedges the loans with $10 million of UM30 2.5% hedges, the risk position isn’t flat. Depending on the population of high-balance loans in the pool, the lender is possibly over-hedging. On top of that, if the duration offset of the loan’s servicing strip is considered, the scenario is over-hedged to an even greater extent.

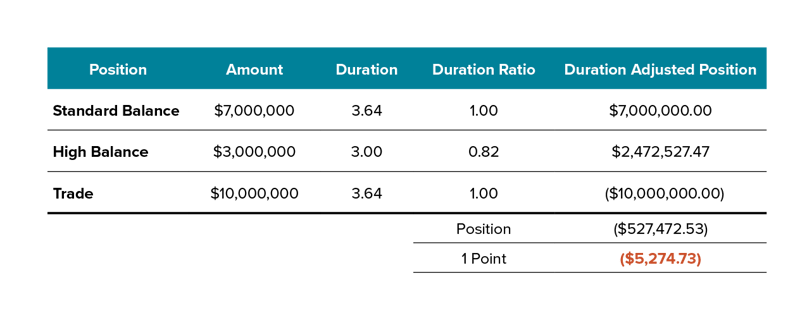

The table below illustrates this example where if the TBA market increases a point this risk position would lose 500k. Imagine if you extrapolated this example to a 100M pipeline or even a 1B pipeline of loans to be hedged.

We touched on cross-hedges briefly, but what about higher-than-average or lower-than-average coupons? Due to the illiquidity of coupons such as UM30 1.5% or UM30 3.5% in markets where most production is slotting UM30 2.5% or UM30 3.0%, hedgers will often cross-hedge them with more liquid coupons.

- Higher or lower coupons lack liquidity, so they are typically cross-hedged with more liquid coupons making duration ratios critical.

This is yet another reason why durations are so important. Most hedgers will use durations to create hedge ratios so they know, for example, $750,000 of a UM30 2.5% is needed to hedge $1 million of UM30 3.5% production. If that ratio or underlying duration is off, they could be over- or under-hedging their position.

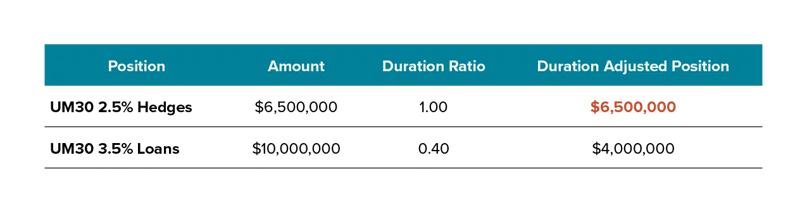

For example, if the UM30 3.5% hedge ratio is off by 25 basis points, it would amount to a material amount of hedge ratio differential. If the hedger has a 0.65 hedge ratio for a UM30 3.5% and they are cross-hedging with a UM30 2.5%, they will need $6.5 million of UM30 2.5% hedges to cover $10 million in UM30 3.5% production.

The table below illustrates this example.

If the hedge ratio for the UM30 3.5% is actually 0.40, as opposed to 0.65, then the hedger is $2.5 million over-hedged. If the market rallied, the hedger would lose approximately $25,000 based on the position being over-hedged for this cross-hedge. This point further solidifies the importance of having accurate durations for higher-than-average or lower-than-average coupons, and for certain types of atypical loan scenarios.

A common problem that hedgers run into is attributing daily Gain Loss on days when there isn’t a smoking gun (e.g., new servicing grids, new buyup/buydown investor pricing moving differently than the market). A common cause of this problem is the issues that we highlighted earlier that lurk in the shadows of G/L attribution. Shining a light on these subjects and reviewing some of the basics regarding durations and hedging is critical to profitability in especially the current market rate environment.

These are just a few reasons why duration profiles are a key metric that lenders should consider as part of an effective and thorough hedging strategy.