Unlock new value from existing borrowers with Capture for Originators

Smarter refinance targeting for stronger borrower retention

Retention strategy and refinance analysis for originators

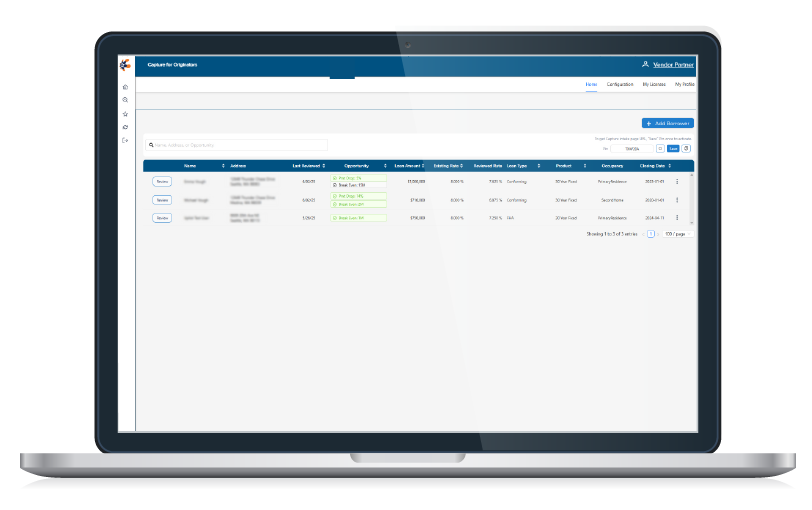

Capture for Originators within the Optimal Blue® PPE enhances management of refinance opportunities for loan officers beyond simple rate alerts. This feature provides an in-depth dashboard and analysis of closed loans, significantly reducing the time loan officers spend researching and investigating opportunities.

Optimal Blue Launches New Lead Generation Tool for Originators

can be completed with just one click.

Capture for Originators helps loan officers stay connected with past closed loans, enabling them to help borrowers in identifying the right time for refinancing, building loyalty and retention.

Time Savings and Reduction of Manual Work

Save loan officers hours per week reviewing, researching, and calculating refinance opportunities.

Retention Strategy for Past Loans

Capture for Originators provides a comprehensive dashboard for tracking and filtering past closed loans, making it easier for originators to identify recapture opportunities.

Automated Customer Outreach

Once refinance options are identified, loan officers can initiate borrower outreach with a single click. Pre-built templates make it simple to compile and send an automatically generated PDF that summarizes several refinance paths, giving borrowers the clarity they need to make informed decisions.

Referral Intake

Easily collect key borrow details from referrals using intake forms.

KEY FEATURES

Comprehensive Dashboard for Monitoring

Easily view past closed loans in a user-friendly dashboard. Filter based on current rates and other criteria.

No Integrations Needed

Access all necessary data sources, such as AVM, county records, and pricing elements automatically, without needing to integrate with other providers.

Automatic and Accurate Calculations

Save time with built-in calculations for break-even periods, savings, closing costs, and more. Capture for Originators leverages the unmatched accuracy of the Optimal Blue PPE to provide calculations in real-time, eliminating the need for Excel or manual work.

Add or Invite a Borrower

When you receive a recommendation from a past client, easily input key borrower details into the dashboard. Additionally, choose to email an intake form directly to the prospect to quickly collect key information like their current address, rate, and more.

Concession & Lender Fees

Manage and track concession and lender fees efficiently.

Logged Activity Per Borrower

See an audit log and record of all outreach activity for each borrower. Review past scenarios shared and track transaction activity to stay informed and organized.

Fill out the form to speak with an Optimal Blue expert about Capture for Originators.