Execute the Most Profitable Lending Strategies & Stay Competitive With the Industry’s Leading PPE

Our end-to-end enterprise automation improves secondary marketing accuracy, efficiency, workflow and execution – throughout the mortgage loan life cycle.

New innovations in the Optimal Blue PPE

Best Efforts Direct Lock

Eliminate manual locking steps and accelerate efficiency through automation

Direct Best Efforts Lock with Investors in the Optimal Blue PPE delivers unmatched accuracy and efficiency through new automation. It removes the final manual step in the locking lifecycle enabling lenders to lock directly with participating investors via API.

Read more in our recent press release.

For Lenders:

- Instant execution: Complete best efforts locks in seconds. No more reentering data into investor portals.

- Fewer errors: API-based data transmission ensures accuracy and reduces compliance risk.

- No disruption: Seamless integration with your LOS preserves existing workflows.

- Zero setup: Available out-of-the-box for Optimal Blue PPE clients – no IT lift required.

- Audit-ready: Downloadable PDF confirmations provide a clear record of every lock.

For Investors:

- Competitive edge: Attract more lender volume by offering a faster, more seamless locking experience.

- Operational efficiency: Reduce support overhead by eliminating manual locking steps for your clients.

- Dedicated Onboarding and Support: For investors interested in participating in direct locking, contact your account representative.

Rules Optimizer – Now Available

Implement global rules quickly, easily, and accurately

Rules Optimizer allows lenders to streamline the rule creation process by creating a single rule and applying it to multiple investor relationships. This gives lenders flexibility to take advantage of both one-to-one and one-to-many investor relationships or custom rule writing. Rules Optimizer is built on top of the Optimal Blue PPE’s system-maintained ratesheet content, which is regarded for its industry-leading accuracy.

- Save time and repetitive work by allowing one rule to be applied to multiple products and/or investors.

- Schedule run periods in advance to support specials and limited-time promotions.

- Group multiple rules together for easier updating.

- See change history tracking so users can easily see updated rules and investors/products at a granular level.

- Choose the rules approach that works for your business

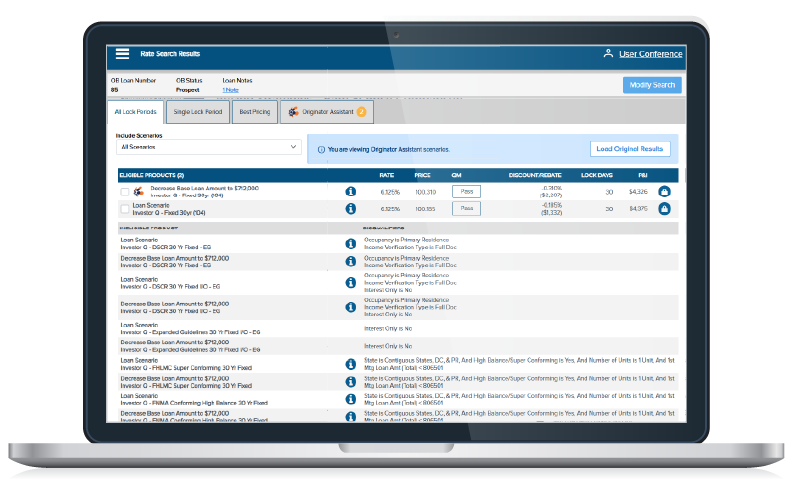

Originator Assistant – Now Available

AI-powered recommendation engine

Originator Assistant leverages the power of AI to give loan officers recommendations and insights to help identify alternate loan scenarios to offer more options for borrowers.

- AI tools look at pricing elements behind the scenes saving loan officers time and training on what items can and cannot be adjusted.

- Automatically identify key breakpoints to maximize borrower options.

- Fetch pricing in a “what if” context across multiple loan scenarios without locking.

- Originator Assistant runs automatically – no integration or setup time.

Read more in our recent press release.

Lock Extension Enhancements – Now Available

Lock Extensions within the Optimal Blue PPE have been reimagined and enhanced for optimal efficiency.

- Increase Automation and Reduce Manual Work: Minimizes redundant tasks by allowing configurations to be set across multiple investors using global product groups (launched earlier in 2025). Speed up lock extensions with new controls to eliminate manual reconciling and clear outs.

- More Control and Flexibility Over Key Lock Extension Characteristics: Utilize new toggles in the lock extension policy creation workflow to ensure compliance implications, pricing disclosures, and other factors are considered with each policy.

- Analyze and Automate Lock Extension Reasons: Customize lock extension reasons and set up automations for auto-acceptance. Gain insights into common lock extension reasons that may be causing delays in locking.

- Improve Cost Configurations: Add free days and configure up to 6+ lock extensions per loan.

Read more in our recent press release.

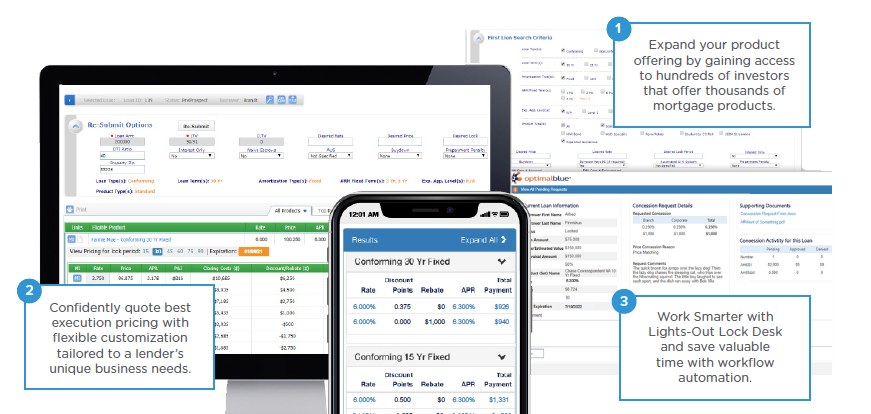

Provide Borrowers the Right Product at the Best Price

Maximize the power of your product, pricing & eligibility (PPE) technology with these key capabilities to compete effectively.

WHITE PAPER

6 Essential Considerations When Choosing a PPE

Learn more about how these key factors and Optimal Blue solutions can help you achieve your business goals.

CASE STUDY

Optimal Blue Key to Alliant Credit Union’s Mortgage Business Transformation

OPTIMAL BLUE DOESN’T STOP AT PRODUCT ELIGIBILITY & PRICING

Our innovative technology and platform automation improves secondary marketing accuracy, efficiency, workflow, and execution – throughout the mortgage loan life cycle.

Optimal Blue PPE

Confidently execute profitable lending strategies with the industry’s leading PPE platform

Hedge Analytics

Manage pipelines, mitigate risk, and improve profitability with leading analytics software

Loan Trading

Optimize execution with the industry’s largest fully automated loan trading platform

Social Media Solutions

Capture new opportunities with a robust, all-in-one social media automation platform

Investor Content Distribution

Generate more leads with innovative pricing tools and online advertising integrations

Enterprise Analytics

Evaluate trends, strategy, and organizational efficiency with captivating visualizations

Competitive Analytics

Compete more effectively knowing where you stand in comparison to peers in every market

Market Analytics

Inform profitable decision making using our comprehensive and proprietary mortgage market data

Originator Pricing Insights

Leverage near real-time, fully adjusted pricing comparisons to market competitors by lending volume, MSA, and more

Technology Vendor Network

Benefit from turnkey integrations with the industry’s leading technology providers

Optimal Blue API Libraries

Leverage an extensive API library to create custom integrations with your systems

This information is subject to change at any time and without notice.