Access Premier Hedging and Trading Tools, Data and Analytics in One, User-friendly Platform

This first-of-its-kind hedging and trading solution merges Optimal Blue’s unmatched pipeline risk management tools and analytics with dynamic loan sale and MSR valuation functionality.

- Mike Vough, Vice President, Hedging and Trading Products, Optimal Blue

New innovations in Optimal Blue’s CompassEdge

Pool Solver

Automate loan pooling with precision and speed – no manual work required.

Pool Solver, part of the CompassEdge hedging and loan trading platform, replaces manual Excel-based pooling with a powerful solver algorithm that forms investor-eligible loan pools in minutes. By applying investor-specific constraints with 99.99% accuracy, Pool Solver ensures compliance, boosts execution value, and saves hours of manual effort – no matter your institution’s size.

- Automated optimization: Instantly form compliant loan pools using investor-specific rules like high balance limits and de minimis thresholds.

- Execution-first logic: Aggregate best-ex logic prioritizes total pool value – even if it means pulling a loan from its top individual price.

- No spreadsheets, no errors: Eliminate manual entry and reduce risk with solver-driven accuracy.

- Scalable and simple: Works out-of-the-box for both high-volume and smaller institutions with minimal configuration.

- Built into CompassEdge: Seamless integration means no additional setup or IT lift required.

Pool Solver is the only solution that brings this level of automation and precision to the pooling process – making it faster, smarter, and easier to scale.

CompassEdge Ratesheet Tool

Connect front-end pricing with back-end pricing

The Ratesheet Tool connects front-end pricing (i.e., origination) with back-end pricing (i.e., secondary) to allow lenders to generate ratesheet pricing with a known margin, accurately. Linking to both the Optimal Blue PPE and the CompassEdge hedging and loan trading platform, the Ratesheet Tool allows secondary users to access a back-end price and deliver a more accurate execution price to originators.

- Offers a new way for lenders to generate ratesheets with their own proprietary pricing.

- Ensures precision and accuracy from secondary to origination.

- Manage risk at the point of origination through the seamless, end-to-end connection of the Optimal Blue ecosystem.

- Incorporate any execution method for front-end pricing including best efforts, agency cash, agency MBS various servicing valuations, and even bulk bid valuations.

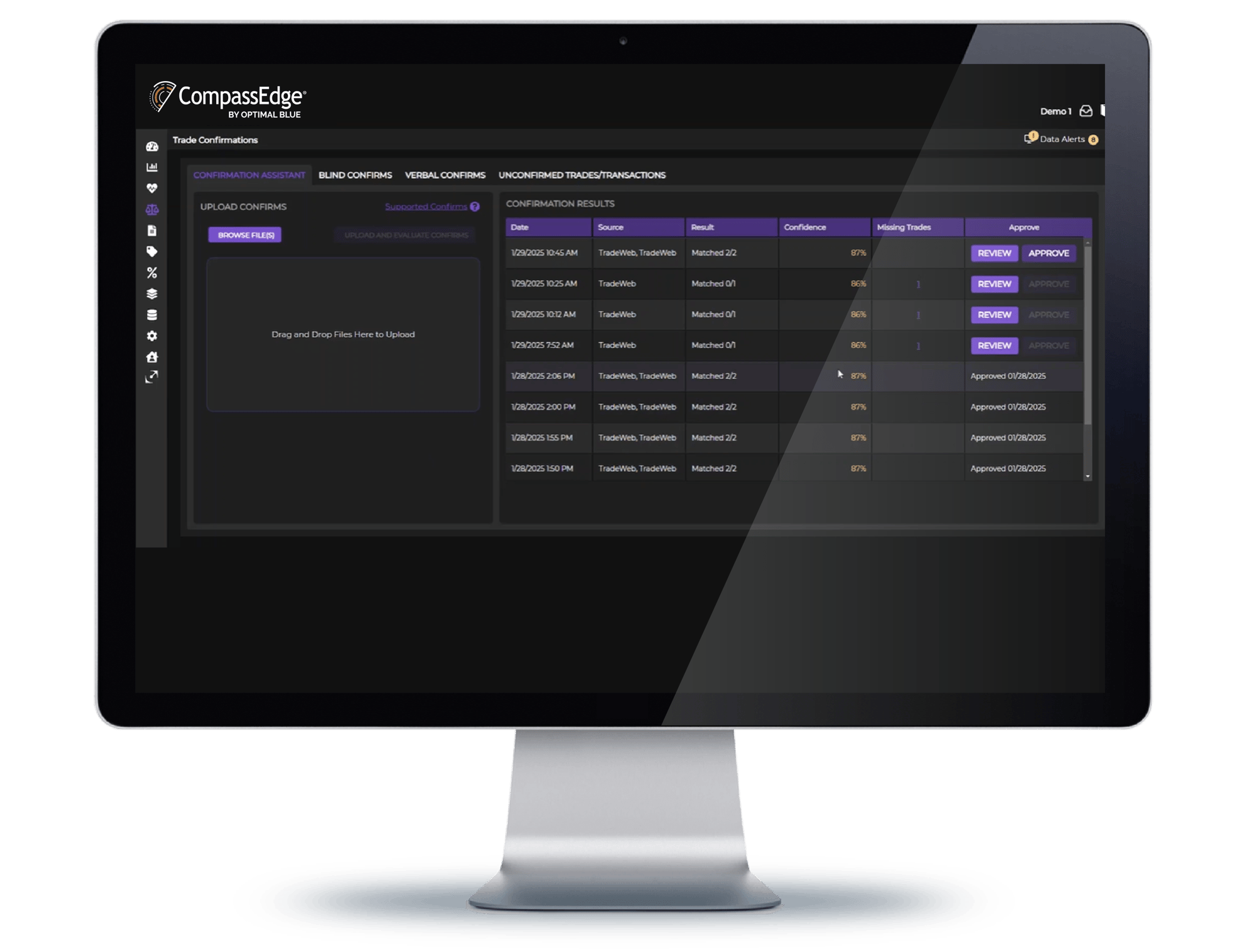

Confirm Assistant

Confirm Assistant is a feature that reduces both the time and potential for manual errors associated with reading and intaking TBA trade confirmation files. The tool uses AI analysis to read files from broker-dealers, parsing the documents into usable formats.

- Simply drag and drop confirmation files and approve them without having to manually key in data.

- Reduce manual, time-consuming steps and freeing up staff to focus on more complex trades.

- Flexibility to change service levels without having to change staffing levels.

New AI Hedging & Trading Innovations from Optimal Blue

Confirm Assistant

Uses AI document analysis to process TBA trade confirmation files quickly.

Position Assistant

Automates the consumption of Optimal Blue’s extensive data sets and completes complex calculations to deliver extremely granular projections for position management.

Profitability Assistant

AI-driven profitability insights for CFOs and executives.

Projection Assistant

Uses AI to predict the real-time impact of various factors on the risk profile of a hedged mortgage pipeline, including originations, fallout, loan sales, and more.

Trade Assistant

Uses AI to reduce the guesswork that goes into the selection of a hedge, a process that would otherwise require an experienced capital markets professional.

INFOGRAPHIC

Top 5 Benefits of Hedging and Trading With Optimal Blue

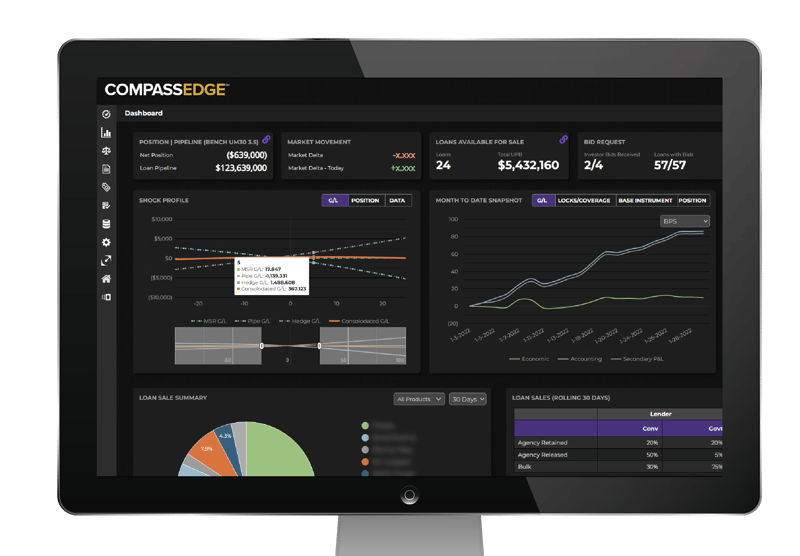

The unprecedented CompassEdge hedging and trading platform combines the power and capabilities of CompassPoint, Optimal Blue Secondary Services, and Resitrader to deliver a single, comprehensive solution built for every originator – regardless of range, size, or type.

CompassEdge promotes greater transparency across organizations by making premier analytics accessible to any capital markets participant – from the lock desk to the C-suite – without requiring in-depth system training. The platform’s intuitive interface and mobile functionality also make it easy for any user to access key data and tools from any location. This includes the CompassPoint Loan-Level Cash Flow engine, CompassPoint Pool Optimizer, and Resitrader trading workflow.

Comprehensive,

easy-to-use functionality

Streamlined workflow allows loan sales in just six clicks

Analytics accessible to

any credentialed user

Key data and tools

available on homepage

Scalable for each

originator’s unique needs

Intuitive interface and mobile functionality

Intuitive User Interface

CompassEdge presents relevant, actionable tools via a user-friendly interface with streamlined navigation. The platform conveniently displays key data and functions on the homepage, making it immediately accessible upon login. Mobile-friendly dashboards also allow users to access financial modeling, reporting and analytics from any device.

CompassEdge users have access to extensive peer data, as well as unrivaled data from the Optimal Blue® PPE, which is used to price and lock 42% of mortgages completed nationwide.

All Optimal Blue clients receive unparalleled support and expertise for their operations from secondary marketing and capital markets experts who hold decades of industry experience. Through enhanced visibility, CompassEdge amplifies the already-outstanding support the Optimal Blue team delivers to clients.

Fill out the form to speak with an Optimal Blue expert about CompassEdge.

This information is subject to change at any time and without notice.