The March 2020 bond rally set off by the global pandemic may have passed, but the impact of the volatile 2020 TBA market persists – even as the Federal Housing Finance Agency (FHFA) proposes new liquidity requirements.

On Feb. 24, 2022, the FHFA proposed a number of financial requirements for enterprise seller/servicers in its Re-Proposal to Enhance Eligibility Requirements for Enterprise Single-Family Seller/Servicers. This includes a 200-basis-point (2%) origination liquidity requirement on non-depository seller/servicers’ outstanding TBA hedging positions, effective Dec. 31, 2022. The change is intended to mitigate risk for seller/servicers vulnerable to spikes in the TBA market and the resulting possible margin calls.

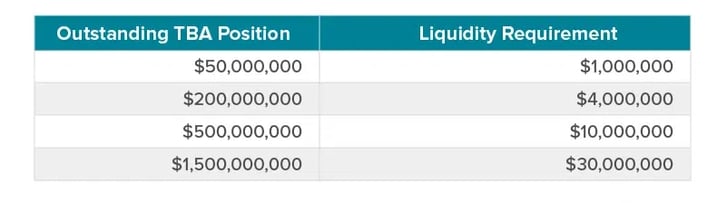

Under the Re-Proposal, all non-depository seller/servicers (note that this would not apply to IMBs that are not approved seller/servicers) must hold 2% of forward TBAs to meet minimum net worth requirements. The FHFA determined that having 2% of TBA lines covered by increasing liquidity requirements should create a sufficient buffer in stress events, such as the pandemic market volatility of March 2020. The size of a seller/servicer’s TBA position roughly corresponds to the volume of loans sold over a 45- to 60-day timeframe. The table below provides examples of the liquidity requirements for various TBA position sizes.

There is no change to asset requirements to meet minimum liquidity requirements, which include: unrestricted cash and cash equivalents; available-for-sale or held-for-trading securities; agency MBS; obligations of GSEs; and U.S. Treasury obligations. These minimum financial requirements are to be evaluated quarterly by Fannie Mae and Freddie Mac to ensure compliance.

Per the Re-Proposal, this requirement is a reaction to concerns raised during the early days of the pandemic that mortgage lenders utilizing MBS securities to hedge open locked pipelines were under so much market pressure the entire financial system risked failure. At the time, forced hoarding of liquid assets mirrored the pandemic hoarding of toilet paper and hand sanitizer.

Another significant problem seller/servicers faced in March 2020 was drastically decreased servicing values. This was especially difficult for non-depository institutions. Seller/servicers received disjointed cash flows from investors (including other, larger non-depository seller/servicers) on loan sales. The problem wasn’t just margin calls, but also an imbalance between loan sales and TBA changes. Loans sales were bringing in lower cash values because investors could not and/or did not put a price on servicing as margin calls were coming down from broker/dealers.

The FHFA’s Re-Proposal could exacerbate problems for smaller seller/servicers if TBA and loan execution prices become disjointed. They would be forced to hold more cash in reserves, or slow down production to meet the proposal’s liquidity requirement, while facing investor basis on execution prices. This could result in a cash crunch for entities that do not have a servicing appetite.

While these proposed liquidity changes are not yet imminent, responses from the MBA and others are being reviewed. If the FHFA decides to move forward, changes will be effective in December 2022. Watch for more news about this as the summer continues.

To learn more about the FHFA’s proposed changes, and steps you can take to prepare for the liquidity requirements, contact Optimal Blue Hedging Product Manager Steve Norak.

Nothing herein shall be construed as, nor is Black Knight providing, any legal, trading, hedging or financial advice.