Consider the direct impact of our recent favorable rate trend on lender profitability. In the paragraphs below, we examine how lower mortgage rates can equate to higher margins for lenders as seen through the primary-secondary spread.

The primary-secondary spread is a widely tracked and closely watched metric because it provides insight into the margins, and thus profitability, of originators. The primary-secondary spread is the difference between mortgage rates for borrowers (the primary rate) and yields on newly-issued, agency, mortgage-backed securities or MBS (the secondary rate). Taking the spread and subtracting other components such as the guarantee fee and servicing fee gives some indication, although imperfect[1], of the profit margins of mortgage originators.

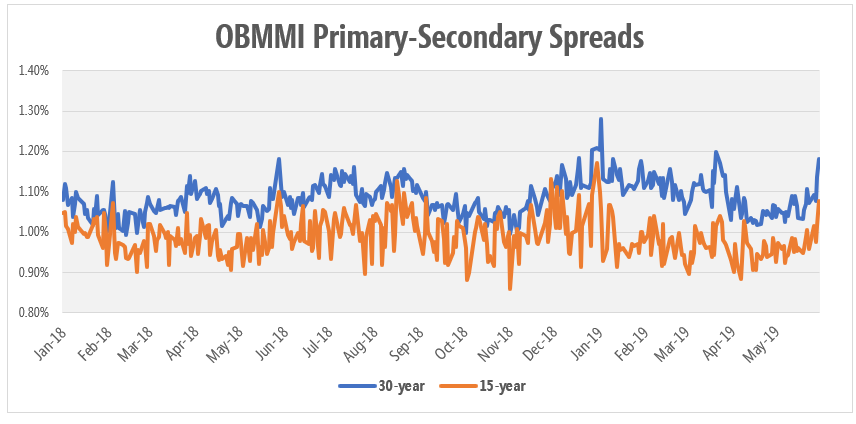

In constructing the primary rates for these spreads, we utilized the Optimal Blue Mortgage Market Indices™ or OBMMI™ and limited the loan population to very high-quality qualifying mortgages, with FICO scores above 740 and LTV[2] below 80. The secondary rates are defined as the current coupon MBA yield sourced from Bloomberg™ for both the conforming 30-year and conforming 15-year fixed rate mortgages.

[1] This measure of margins abstracts away from borrowers buying the rate up or down and the level of closing costs.

[2] Loan to Value

Our research shows that the change in the spreads is inversely related to the movements of the underlying rates being offered in the market, implying that when rates are low, margins increase. Considering the last two significant drops in mortgage rates - the last two months of 2018 and, again, more recently in the second quarter of 2019 – there are corresponding spikes in the primary-secondary spread.

Typically, originators are focused on demand, trying to get as much as possible and aren’t running into any capacity constraints. However, when rates drop sharply, there is an increase in refinance activity, which increases demand and puts pressure on capacity. To alleviate this pressure, demand is controlled by increasing the margins, or quoting a slightly higher rate than the underlying bond market would suggest. This increase in margins, combined with lower costs of credit that exist in a low interest rate environment, can lead to increased organizational profitability.

ABOUT OPTIMAL BLUE MORTGAGE MARKET INDICES (OBMMI)

The Optimal Blue Mortgage Market Indices™ or OBMMI™ are uniquely positioned to provide unparalleled transparency into mortgage rates by utilizing observed, real-time lock data from approximately 30% of the market. This data is aggregated daily and split in informative and novel ways, covering not only conventional 30- and 15-year fixed rate indices, but also FHA, USDA, VA, and Jumbo, as well as many Detailed Mortgage Indices of the Conventional 30 group based on Loan-to-Value (LTV) and FICO credit score. The OBMMI deliver the most complete, frequent, and informative view of the mortgage rate environment based solely on observed, real-time transactions. For more information, please visit www.optimalblue.com/obmmi.

Sources:

Bloomberg L.P. (2019) MTGEFNCL Index and MTGEFNCI Index 1/1/2018-5/31/2019. Retrieved June 3, 2019 from Bloomberg database.