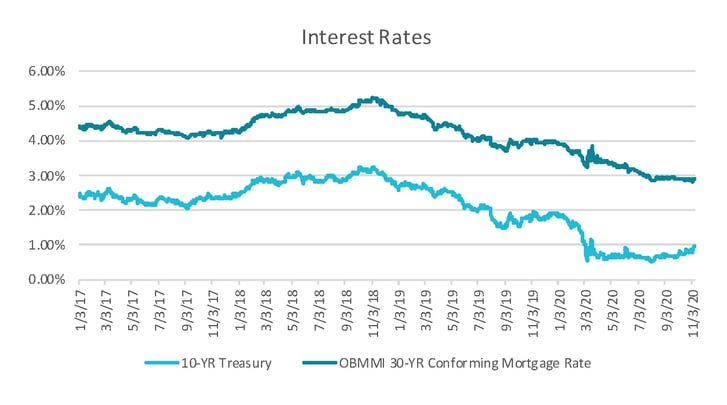

Early on in response to the COVID-19 pandemic, the Federal Reserve re-engaged quantitative easing measures, injecting liquidity into the market and driving the 10-year Treasury to ~50 bps and mortgage rates below 3% for the first time. In the months since, interest rates have marked 13 record lows and have hovered in the 2.75-3.00% range for the better part of the last six months.

In recent weeks, however, Treasury yields have begun to climb as investors become more bullish on an economic recovery and migrate away from safe-haven assets. Midway through November, the 10-year Treasury yield sits roughly 30 bps higher than its summer lows. The question for mortgage borrowers and lenders alike is, does the rise in government bond yields signal the beginning of the end to the friendliest rate environment in history?

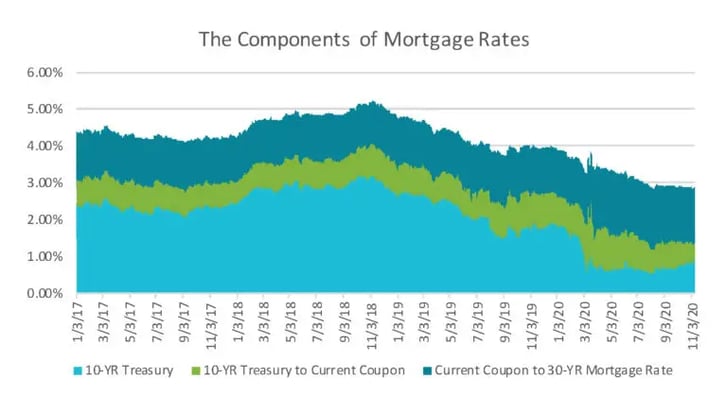

The answer is, of course, “maybe.” Although mortgage rates are highly correlated with Treasury yields, that relationship alone does not fully determine mortgage rate behavior. In order to assess the potential impact, it’s helpful to think about mortgage rates as the sum of three different components:

- The risk-free rate of Treasury yields;

- The risk-based spread between Treasury and MBS yields (measured by the Current Coupon, an interpolated yield for a hypothetical TBA at par); and

- The spread between the Current Coupon and the primary mortgage rate (known as the Primary Secondary Spread and a measure of the cost to produce a mortgage).

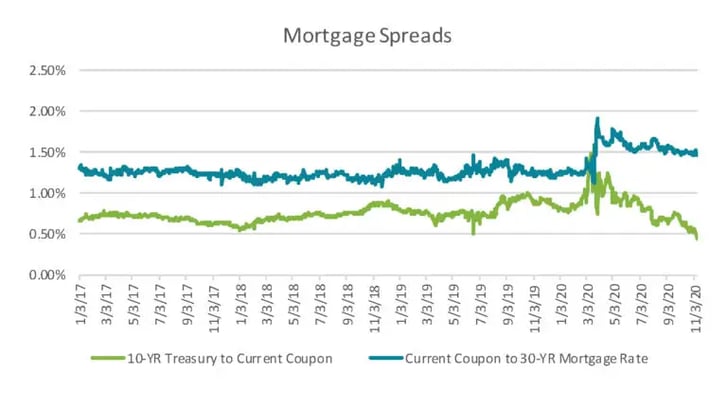

Using that construct, we can see in the chart above that although Treasury yields have risen, that has not translated into rising mortgage rates. Instead, the rising Treasury yields have only served to narrow the spread to MBS yields, which remain at record lows due to continued, significant MBS purchases by the Fed.

Until these quantitative measures are rolled back, the yields on MBS and mortgage rates will likely be materially insulated from other market factors that would otherwise drive rates higher. In fact, the Primary Secondary Spread (PSS) remains elevated at about 25 basis points above its historical average, suggesting that mortgage rates could drop without corresponding reductions to the underlying measures.