Published February 17, 2022

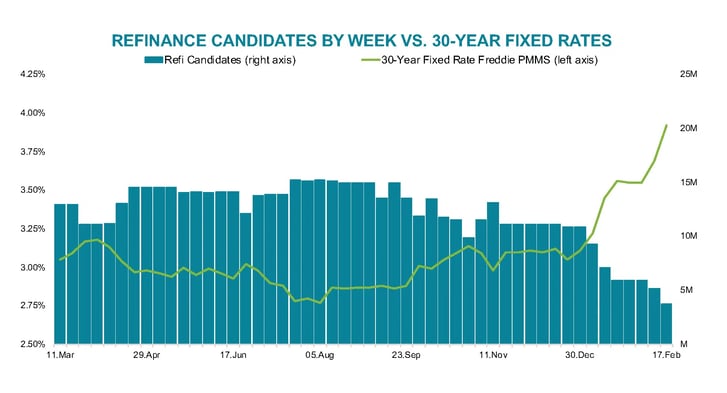

Up and up, they go. Today’s Freddie Mac Primary Mortgage Market Survey (PMMS) showed the average 30-year conforming mortgage rate at 3.92%. That’s the highest rates have been since May 2019, and the jump has big implications for the refinance market.

The latest numbers from Freddie have cut the pool of high-quality refinance candidates significantly. The population continues to dwindle, with millions of borrowers having lost rate incentive to refinance in the last month and a half.

The clock is ticking. PMMS looks at historical data. Our OBMMI daily interest rate tracker shows 30-year conforming rates have continued to climb over the past week.

As of today, just 3.8 million remain – down from about 11 million entering 2022 and nearly 20 million back in 2020.

These remaining rate-driven refinance candidates could benefit from an aggregate potential $1 billion in monthly savings, or about $284/month per borrower, should they decide to refinance today.

Drilling deeper into the data, we see just 750,000 candidates remain who could save at least $400 per month by refinancing, and less than half a million who could save $500 or more per month.

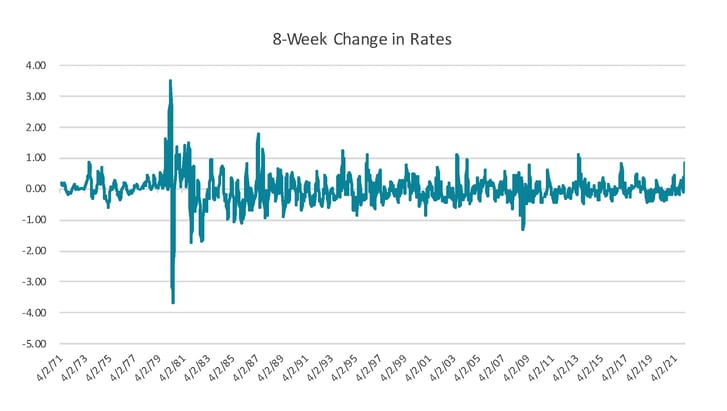

This uptrend, though not unprecedented, is significant. We’ve only seen rates rise as sharply and quickly as they have over the past 8 weeks (+ 87 basis points) roughly a dozen times over the past 50 years.

The last time they rose this fast was during the so-called “Taper Tantrum” of 2013, when interest rates spiked following the Fed’s curtailing of post-recession quantitative easing.